Categories

Categories

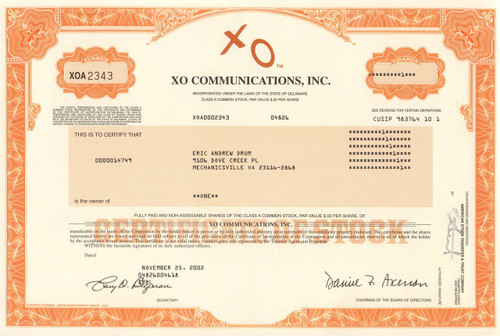

XO Communications 2002

Product Description

XO Communications stock certificate 2002

Great telecom bomb stock cert with a vignette of the company's logo. Printed signature of David Ackerman as president. Difficult piece to find but still offered at a great price. Issued and not cancelled. Dated 2002.

XO Communications (previously Nextlink Communications, Concentric Network Corporation and Allegiance Telecom, Inc.) is a telecommunications company owned by XO Holdings, Inc OTCBB: XOHO. XO provides managed services and converged Internet Protocol (IP) network services that combine voice, Internet access, and private data networking for small and medium-sized companies, enterprises, national and government accounts. XO delivers services through a mix of fiber-based Ethernet and Ethernet over Copper (EoC). In addition, the company has external network-to-network interface (E-NNI) agreements with traditional carriers and cable companies.

History and bankruptcy:

XO Communications Inc., the telephone and Web service provider founded by Seattle-area billionaire Craig McCaw and fought over by financiers Carl Icahn and Theodore Forstmann, let a bankruptcy judge help sort out its financial future in 2002. XO filed for Chapter 11 protection from creditors in the second-biggest bankruptcy filing by a telecommunications company after Global Crossing Ltd. XO listed assets of $8.7 billion and liabilities of $8.5 billion, including $4.4 billion owed lenders, in the U.S. Bankruptcy Court filing in Manhattan, N.Y.

The move gave the company time to forge an alternative reorganization in case buyout firm Forstmann Little & Co. and Mexican phone company Telefonos de Mexico SA back out of a plan to invest $800 million. Forstmann and Telmex have said they might cancel the investment, which was proposed in November and expires Sept. 15, because XO's finances have deteriorated. "Either plan requires a Chapter 11 filing to implement," said Bruce Kraus, an XO lawyer with the firm of Willkie Farr & Gallagher in New York. "It reshapes the legal obligations of the company with the help of a judge."

XO and Global Crossing, which had assets of $22.4 billion when it filed for bankruptcy, were among the telecommunications companies seeking creditor protection after failing to generate enough revenue to service their debts. Williams Communications Group Inc. and Metromedia Fiber Network Inc. also filed for protection from creditors.

Loading... Please wait...

Loading... Please wait...