Categories

Categories

- Home

- Banking and Money

- Investing

- Smith Barney Equity Fund 1970 (They make money the old-fashioned way. They earn it)

Smith Barney Equity Fund 1970 (They make money the old-fashioned way. They earn it)

Smith Barney Equity Fund 1970 (They make money the old-fashioned way. They earn it)

Product Description

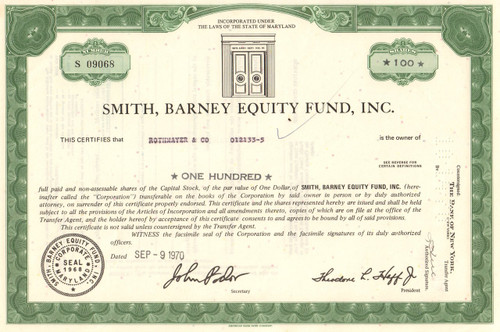

Smith Barney Equity Fund stock certificate 1970

Great collectible cert from the famous brokerage. Tough piece to find. Vignette features a bank entrance with the fund name above the doors. Issued and cancelled. Dated 1970.

Smith Barney was a brokerage company founded in 1873. In recent years, it has undergone several ownership and name changes, most recently having shared its name with joint venture partner Morgan Stanley. In September 2012, Morgan Stanley and parent company Citigroup officially retired the Smith Barney name, rebranding the unit as Morgan Stanley Wealth Management.

Smith Barney & Co. was formed in 1938 through the merger of Charles D. Barney & Co. and Edward B. Smith & Co.. Charles D. Barney & Co., a New York and Philadelphia based firm, was founded by Charles D. Barney in 1873 following the failure of its predecessor Jay Cooke & Company. Edward B. Smith & Co., founded in 1892 became a significant player in securities underwriting in 1934 when the firm absorbed the professionals from the securities business of Guaranty Trust Company, following the passage of the Glass Steagall Act.

In 1975, Smith Barney merged with Harris, Upham & Co. to form Smith Barney, Harris Upham & Co., which, in 1977, was placed under SBHU Holdings, a holding company. In 1982, SBHU Holdings was renamed Smith Barney Inc. During the 1980s, the company was known for its television commercials featuring actor John Houseman, with the catchphrase, "They make money the old-fashioned way. They earn it."

In the late 1980s, the retail brokerage firm Smith Barney was owned by Sanford I. Weill's Primerica Corporation. Commercial Credit purchased Primerica in 1988, for $1.5 billion. In 1992, they paid $722 million to buy a 27% share of Travelers Insurance and in 1993 acquired Shearson (which included the legacy business of E.F. Hutton from American Express). By the end of 1993, the merged company was known as Travelers Group Inc. although the brokerage business continued to operate under the Smith Barney brand.

In 1993, Weill bought stockbroker Shearson back from American Express for $1 billion, and merged it into Smith Barney. Weill offered Joe Plumeri the presidency of Smith Barney, and he became the President of the merged company that year. He only lasted a year, as he experienced conflicts with existing Smith Barney managers.

In September 1997, Travelers acquired Salomon Inc., for over $9 billion in stock, and merged it with its own investment arm to create Salomon Smith Barney. In April 1998 Travelers Group announced an agreement to undertake a $76 billion merger between Travelers and Citicorp, creating Citigroup, which at the time of the merger was the largest single financial services company in the world.

During the major financial crisis beginning in late 2008, Citigroup suffered large losses in its retained collateralized debt obligation exposure, and had to be rescued by the U.S. federal government. They decided to sell or close "non-core" businesses in order to raise money. On January 13, 2009, Morgan Stanley and Citigroup announced the merger of Smith Barney with Morgan Stanley's Global Wealth Management Group, with Morgan Stanley paying $2.7 billion cash upfront to Citigroup for a 51% stake in the joint venture. The joint venture operates as Morgan Stanley Smith Barney.[11] Morgan Stanley itself was in a financially cash-strapped position like Citigroup during that time, but they were helped by $9 billion investment from Mitsubishi UFJ Financial Group for a 21% stake in Morgan Stanley.

On June 1, 2009, Morgan Stanley and Citigroup Inc. announced they closed early on the launch of their joint venture that combines Morgan Stanley's wealth management unit (including many former Dean Witter assets) with Citi's Smith Barney brokerage division. The new venture, called Morgan Stanley Smith Barney, was supposed to launch during the third quarter. The combined entity generates about $14 billion in net revenue, has 18,500 financial advisers, 1,000 locations worldwide and serves about 6.8 million households.

Loading... Please wait...

Loading... Please wait...