Categories

Categories

- Home

- Banking and Money

- Investing

- Putnam Management Company (famous mutual funds)

Putnam Management Company (famous mutual funds)

Product Description

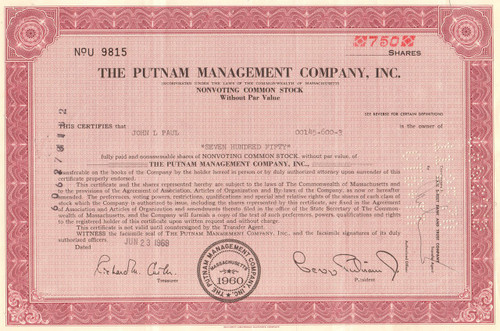

The Putnam Management Company stock certificate 1960's

Nice investment piece from the famous Putnam mutual funds company. Issued and cancelled. Dated 1960's. Great collector piece from Wall Street investing business.

George Putnam founded Putnam in 1937 with The George Putnam Fund of Boston, a balanced mutual fund with a flexible mix of stocks and bonds. The company was incorporated under the Putnam Management name in 1960. Almost 40 years of mutual fund activity, Marsh & McLennan acquired Putnam in 1970, but Putnam didn't stand still in its quest to attract new business. In 2001, the company teamed with private equity firm Thomas H. Lee Partners to offer a fund targeted to wealthy investors, the $1.1 billion TH Lee Putnam Ventures fund.

In January 2006, Putnam's assets under management had dropped from $267 billion to $191 billion in almost two years, and institutional clients dropped from 700 to 175. In the end, Marsh & McLennan received more than 30 inquiries and seven serious bids for Putnam, and in February 2007, Great-West Lifeco inked a deal to acquire Putnam for $3.9 billion in cash.

In May 2007, shareholders in Putnam's 105 funds seconded the sale to North Americas fifth-largest life insurer Great-West Lifeco which doubled its assets worldwide with the addition of Putnam. The deal also helped Great-West's parent company, the Montreal-based Power Corporation of Canada, to achieve its goal of expansion in the United States. Previously, Great-West's main business in America was providing medical insurance to slightly more than 2 million consumers.

The company is now private, operating as Putnam Investments, LLC, and is based in Boston, Massachusetts.

Loading... Please wait...

Loading... Please wait...